Television Broadcasting Technology: A Comprehensive Technical Guide

Understanding the Complete Ecosystem of Television Content Distribution and Security Broadcasting Systems

Table of Contents

- 1. Introduction and Industry Overview

- 2. Broadcasting Technology Landscape

- 3. Terrestrial Television Broadcasting

- 4. Closed-Circuit Television (CCTV) Systems

- 4.1 Technology Evolution from Analog to AI

- 4.2 System Architecture and Components

- 4.3 Network Infrastructure and IP Integration

- 4.4 Artificial Intelligence and Analytics

- 4.5 Market Analysis and Growth Projections

- 4.6 Industry Applications and Vertical Markets

- 4.7 Privacy, Security, and Regulatory Compliance

- 4.8 Implementation Strategies and Best Practices

- 5. Outside Broadcasting and Mobile Production

- 5.1 Historical Development of Mobile Broadcasting

- 5.2 Mobile Production Technology and Equipment

- 5.3 Transmission Technologies and Connectivity

- 5.4 5G Integration and Remote Production

- 5.5 Industry Structure and Market Players

- 5.6 Economic Models and Cost Analysis

- 5.7 Production Workflows and Operational Excellence

- 5.8 Future Technologies and Industry Evolution

- 6. Direct Broadcast Satellite (DBS) Technology

- 6.1 Satellite Broadcasting History and Milestones

- 6.2 Space Infrastructure and Orbital Mechanics

- 6.3 Satellite Technology and Payload Design

- 6.4 Ground Segment and Consumer Equipment

- 6.5 Market Dynamics and Competitive Analysis

- 6.6 International Regulation and Spectrum Coordination

- 6.7 LEO Constellations and Next-Generation Systems

- 6.8 Business Models and Strategic Positioning

- 7. Comprehensive Technology Comparison

- 8. Future Trends and Technology Convergence

- 9. Industry Resources and Professional Networks

Broadcasting Technology Landscape and Market Overview

Television broadcasting represents one of the most complex and sophisticated technological ecosystems in modern telecommunications, encompassing multiple transmission methods, sophisticated signal processing technologies, and diverse application domains. The global broadcasting industry, valued at over $207 billion, continues to evolve rapidly as traditional technologies undergo digital transformation while new paradigms emerge to address changing consumer preferences and technological capabilities.

This comprehensive technical guide examines four primary broadcasting technologies that collectively define the modern media landscape: terrestrial television broadcasting, closed-circuit television systems, outside broadcasting and mobile production, and direct broadcast satellite technology. Each technology serves distinct market segments while contributing to the broader ecosystem of content delivery, security infrastructure, and communication systems.

The convergence of traditional broadcasting with internet protocol networks, artificial intelligence, 5G wireless technologies, and space-based systems creates unprecedented opportunities for innovation while presenting significant challenges for industry stakeholders. Understanding these technologies requires examination of their technical foundations, market dynamics, regulatory frameworks, and strategic implications for future development.

Global Broadcasting Industry Key Statistics

- Total Market Value: $207+ billion globally across all broadcasting segments

- CCTV Segment Growth: 16.84% CAGR projected through 2033

- AI-Powered CCTV: $19.95B (2023) expanding to $70.73B (2032)

- Terrestrial TV Reach: 14% direct household penetration in developed markets

- Satellite TV Challenges: 5M+ subscriber losses in 2023 in mature markets

- Outside Broadcasting: Multi-billion dollar industry supporting live event production

Terrestrial Television Broadcasting

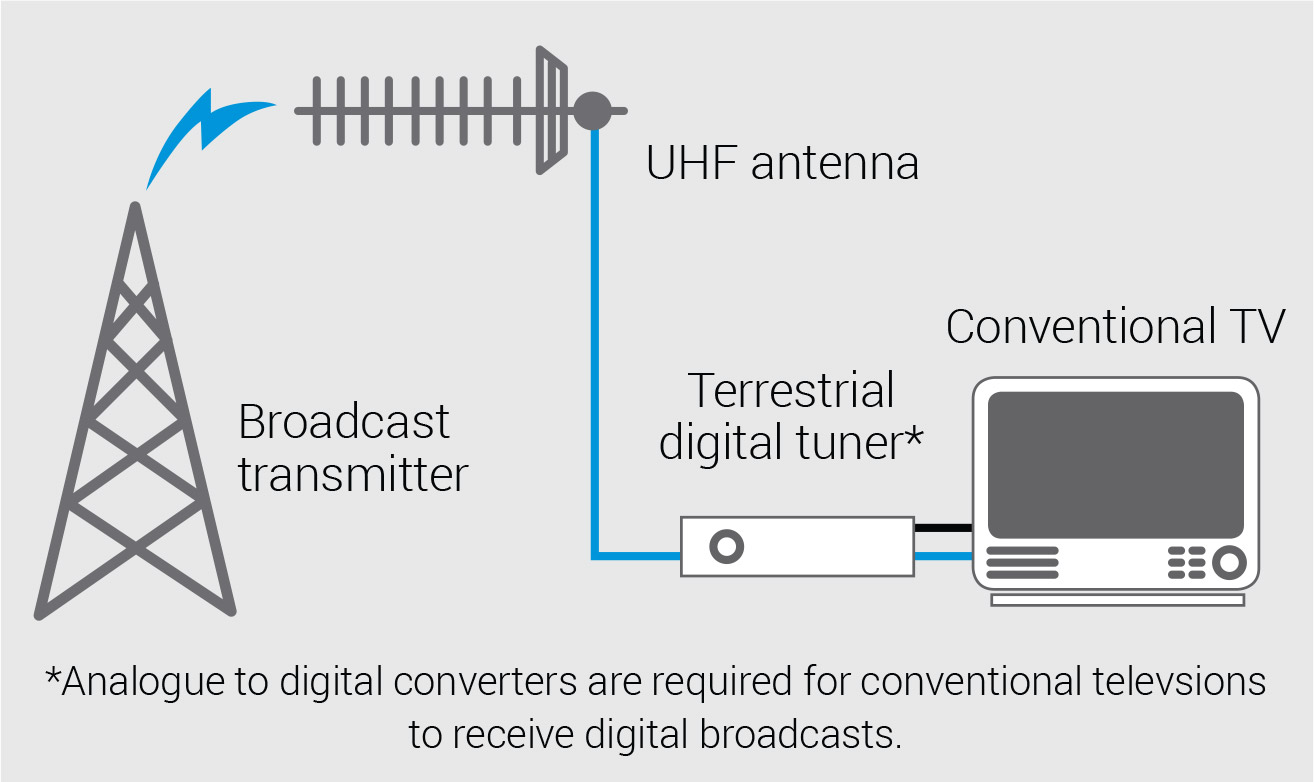

The foundational technology of free-to-air television, utilizing electromagnetic signal propagation through Earth's atmosphere from ground-based transmission facilities. Terrestrial broadcasting represents the most accessible form of television content delivery, requiring only consumer antennas for reception and serving as critical infrastructure for emergency communications and public information dissemination.

Key Characteristics: Free consumer access, wide area coverage, emergency resilience, evolving through ATSC 3.0 next-generation standards enabling 4K video, datacasting, and interactive services.

Closed-Circuit Television (CCTV) Systems

Specialized video broadcasting networks designed for targeted surveillance, monitoring, and security applications. Modern CCTV systems integrate advanced artificial intelligence, cloud computing, and network technologies to provide comprehensive security solutions extending beyond traditional surveillance into process monitoring, quality control, and smart city applications.

Key Characteristics: Private network distribution, AI-enhanced analytics, explosive market growth, expanding applications across multiple industry verticals including retail, healthcare, transportation, and industrial monitoring.

Outside Broadcasting and Mobile Production

Mobile television production capabilities enabling full broadcast studio functionality at remote locations for live event coverage. Outside broadcasting serves as the backbone of sports, news, and entertainment production, utilizing sophisticated mobile equipment, satellite transmission, and increasingly 5G-enabled remote production workflows.

Key Characteristics: Mobile broadcast studios, live event production, satellite and cellular transmission, evolving through 5G integration and remote production technologies reducing on-site crew requirements.

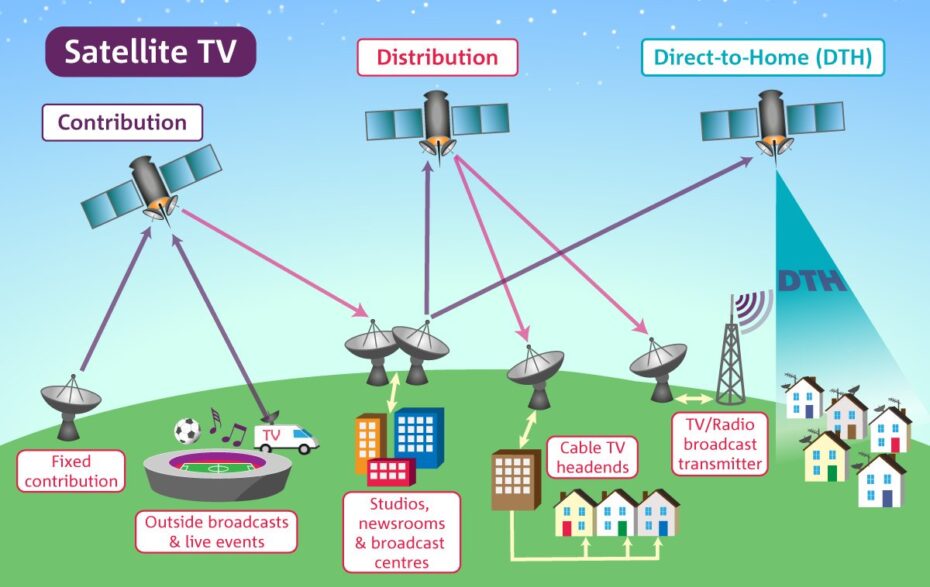

Direct Broadcast Satellite (DBS) Technology

Space-based television distribution utilizing high-powered geostationary satellites to deliver programming directly to consumer locations via small receiving dishes. DBS technology provides continental coverage while facing competitive challenges from streaming services and evolving toward next-generation low Earth orbit constellation architectures.

Key Characteristics: Continental coverage, rural market focus, subscriber decline pressures, technology evolution toward LEO constellations and hybrid broadcast-broadband service models.

Terrestrial Television Broadcasting: Foundation of Free-to-Air Media

Terrestrial television broadcasting represents the most fundamental and widely accessible form of television content distribution, utilizing electromagnetic signal propagation through Earth's atmosphere to deliver programming from ground-based transmission facilities to consumer reception equipment. This technology serves as the backbone of free television broadcasting worldwide, providing essential services including news, entertainment, education, and emergency communications to billions of viewers globally.

Terrestrial Digital Television Broadcasting: Signal transmission from broadcast transmitter to home UHF antenna and digital tuner system

Historical Development and Technological Evolution

The development of terrestrial television broadcasting spans nearly a century of continuous technological advancement, beginning with experimental transmissions in the 1920s and evolving through analog color broadcasting, digital transition, and current next-generation implementations. The fundamental principles of electromagnetic wave propagation and antenna design established in early television systems continue to underpin modern digital broadcasting technologies.

Case Study: United States Digital Transition (2009)

The United States completed its digital television transition on June 12, 2009, requiring all full-power television stations to cease analog broadcasting and operate exclusively in digital format. This transition affected over 1,800 television stations and required consumer education campaigns, converter box subsidy programs, and extensive coordination between broadcasters, equipment manufacturers, and regulatory authorities.

Key Outcomes: Improved spectrum efficiency, enhanced picture quality, increased channel capacity, and freed 108 MHz of spectrum (channels 52-69) for wireless broadband services, generating $19.6 billion in auction proceeds for the US Treasury.

Global Digital Broadcasting Standards Comparison

ATSC (Advanced Television Systems Committee)Geographic Coverage: United States, Canada, Mexico, South Korea

Frequency Bands: VHF-Lo (54-88 MHz), VHF-Hi (174-216 MHz), UHF (470-698 MHz)

Channel Bandwidth: 6 MHz

Modulation: 8VSB (8-level Vestigial Sideband)

Forward Error Correction: Trellis coding + Reed-Solomon

Maximum Data Rate: 19.39 Mbps per channel

Video Compression: MPEG-2 (ATSC 1.0), HEVC/H.265 (ATSC 3.0)

DVB-T/DVB-T2 (Digital Video Broadcasting - Terrestrial)

Geographic Coverage: Europe, Asia, Africa, Australia

Frequency Bands: VHF (174-230 MHz), UHF (470-862 MHz)

Channel Bandwidth: 6, 7, 8 MHz (8 MHz most common in Europe)

Modulation: OFDM (DVB-T), OFDM with enhanced features (DVB-T2)

Forward Error Correction: LDPC + BCH (DVB-T2)

Maximum Data Rate: 31.7 Mbps (DVB-T), 50+ Mbps (DVB-T2)

Video Compression: MPEG-2, MPEG-4/H.264, HEVC/H.265

ISDB-T (Integrated Services Digital Broadcasting - Terrestrial)

Geographic Coverage: Japan, Brazil, Philippines, Argentina, Peru

Frequency Bands: VHF (90-108, 170-222 MHz), UHF (470-710 MHz)

Channel Bandwidth: 6 MHz

Modulation: OFDM with hierarchical transmission

Segments: 13 OFDM segments per channel (flexible configuration)

Maximum Data Rate: 23.23 Mbps per channel

Unique Features: One-seg mobile reception, hierarchical modulation

Each broadcasting standard reflects specific regional requirements, existing spectrum allocations, and technical preferences. ATSC emphasizes robust reception in challenging environments through single-carrier modulation, while DVB-T utilizes OFDM for improved resistance to multipath interference and frequency selective fading. ISDB-T incorporates hierarchical transmission enabling simultaneous fixed and mobile reception within the same channel.

Infrastructure Requirements and Network Architecture

Terrestrial television broadcasting infrastructure encompasses transmission facilities, antenna systems, studio-to-transmitter links, and supporting equipment required for signal generation, processing, and distribution. Professional broadcast facilities represent significant capital investments, with costs varying dramatically based on coverage requirements, terrain characteristics, and regulatory compliance needs.

Economic Model Analysis: Consumer Perspective

Terrestrial Television:

- Initial Equipment Cost: $20-200 (antenna purchase)

- Monthly Service Cost: $0

- Annual Total Cost: $20-200 (one-time)

- Content Available: 20-50+ channels typical in major markets

Alternative Service Comparison:

- Cable Television: $600-1,800 annually ($50-150 monthly)

- Satellite Television: $600-1,800 annually plus equipment

- Streaming Services: $120-960 annually plus broadband costs

- Mobile Data Plans: $480-1,440 annually for video consumption

Closed-Circuit Television Systems: Evolution Toward Intelligent Security Infrastructure

Closed-Circuit Television systems represent a specialized form of video broadcasting designed for targeted surveillance, monitoring, and security applications rather than general public consumption. Modern CCTV systems have evolved from simple analog monitoring networks into sophisticated digital platforms integrating artificial intelligence, cloud computing, and advanced networking technologies to provide comprehensive security solutions across multiple industry verticals.

Modern CCTV Systems: Complete security infrastructure including IP cameras, network video recorders, monitoring stations, and mobile access capabilities

Technology Evolution from Analog to Artificial Intelligence

The evolution of CCTV technology spans six decades of continuous advancement, beginning with analog closed-circuit systems in the 1960s and progressing through digital transition, network integration, high-definition capabilities, and current artificial intelligence implementations. Each technological generation has expanded system capabilities while reducing costs and improving accessibility for diverse applications.

AI-Enhanced CCTV Market Growth

The global CCTV market demonstrates exceptional growth driven by security concerns, smart city initiatives, artificial intelligence adoption, and expanding applications beyond traditional surveillance. Market research indicates explosive expansion with AI-powered systems leading growth trajectories.

Market Statistics: AI-Powered CCTV segment growing from $19.95B (2023) to projected $70.73B (2032), representing a 16.84% CAGR across all broadcasting segments.

AI Analytics Capabilities and Applications

Object Detection and Classification:

- Person Detection: Distinguishing humans from other objects with 95%+ accuracy

- Vehicle Recognition: Car, truck, motorcycle classification and tracking

- Animal Detection: Wildlife monitoring and intrusion prevention

- Object Tracking: Following subjects across multiple camera views

Behavioral Analysis:

- Loitering Detection: Identifying suspicious lingering behavior

- Intrusion Detection: Perimeter violations and unauthorized access

- Crowd Analysis: Density monitoring and flow optimization

- Violence Detection: Aggressive behavior and altercation identification

Biometric Integration:

- Facial Recognition: Identity verification with access control integration

- License Plate Recognition: Automated vehicle identification and logging

- Gait Analysis: Person identification through walking patterns

- Age and Gender Estimation: Demographic analytics for retail applications

System Architecture and Core Components

Modern CCTV systems utilize sophisticated network architectures combining edge devices (cameras), transmission infrastructure, processing systems, storage solutions, and management platforms. The transition to IP-based systems enables integration with existing IT infrastructure while providing scalability, flexibility, and advanced feature support.

CCTV System Architecture Components

Camera Technologies and SpecificationsResolution Categories:

- Basic: 720p (1MP) for general area monitoring

- Standard: 1080p (2MP) for identification and detail capture

- Enhanced: 4MP-5MP for forensic analysis and license plate recognition

- Ultra-High: 8K (33MP) for critical infrastructure and large area monitoring

Sensor Technologies:

- CMOS: 95% of modern cameras, excellent low-light performance

- CCD: Legacy technology, superior image quality in specialized applications

- Thermal: LWIR sensors for heat signature detection and perimeter security

- Multi-sensor: Panoramic cameras with 180°-360° coverage

Compression Standards and Efficiency

H.264 (AVC): Industry standard with 90% market adoption

- Bitrates: 1-8 Mbps for 1080p depending on scene complexity

- CPU Requirements: Moderate encoding/decoding processing

- Storage Efficiency: Baseline for capacity planning

H.265 (HEVC): Next-generation compression with 50% storage reduction

- Bitrates: 0.5-4 Mbps for 1080p equivalent quality

- CPU Requirements: Higher processing demands

- Adoption: Growing rapidly due to storage cost benefits

H.266 (VVC): Emerging standard with additional 50% efficiency improvement

Smart Compression: ROI-based encoding optimizing bandwidth for areas of interest

Outside Broadcasting and Mobile Production: Bringing Studio Capabilities Anywhere

Outside Broadcasting represents the mobile extension of television production capabilities, enabling comprehensive broadcast studio functionality at any location worldwide for live event coverage. This specialized field brings sophisticated television production to remote locations, serving as the technological backbone of sports broadcasting, news coverage, entertainment productions, and special events that define global media consumption.

BBC Outside Broadcasting: Professional mobile production units and equipment setup for live event coverage and remote broadcasting

Historical Development of Mobile Broadcasting

The evolution of outside broadcasting spans nearly nine decades, beginning with experimental radio broadcasts in the 1930s and evolving through television adoption, color broadcasting, satellite integration, digital transition, and current high-definition and 4K implementations. Each technological generation has expanded production capabilities while reducing equipment size and operational complexity.

Modern OB Technology: 5G Integration and Remote Production

The integration of 5G wireless networks represents a fundamental transformation in outside broadcasting operations, enabling ultra-low latency connectivity, massive bandwidth capacity, and network slicing capabilities that guarantee quality of service for critical broadcast applications.

Key Benefits: Remote Integration Model (REMI) production separates technical personnel from event locations, with camera operators and minimal technical crew on-site while directors, audio engineers, and production staff operate from centralized facilities.

Mobile Production Unit Categories and Specifications

Compact OB Vans (4-8 Camera Productions)Typical Size: 30-40 feet long, single vehicle configuration

Camera Support: 4-8 fixed and wireless cameras

Video Processing: HD/4K switcher with 12-24 inputs

Audio Capability: 32-48 input digital mixing console

Graphics: Real-time character generation and replay systems

Crew Capacity: 6-10 technical personnel

Applications: Local sports, news events, corporate productions

Cost Range: £250,000 - £750,000 complete system

Standard OB Trucks (12-20 Camera Productions)

Typical Size: 40-50 feet long, articulated truck configuration

Camera Support: 12-20 cameras with specialty systems

Video Processing: Large production switcher with 32+ inputs

Audio Capability: 64-96 input console with full processing

Graphics: Advanced 3D graphics and augmented reality systems

Crew Capacity: 15-25 technical personnel

Applications: Professional sports, major news events, award shows

Cost Range: £1.5M - £3M complete system

Large OB Trailers (24+ Camera Productions)

Typical Size: Multiple trailers with expanding sides

Camera Support: 24+ cameras including specialty units

Video Processing: Multi-level switcher with 64+ inputs

Audio Capability: 128+ input digital console

Graphics: Comprehensive graphics and virtual set systems

Crew Capacity: 30-50+ technical personnel

Applications: Olympics, World Cup, Super Bowl, major concerts

Cost Range: £3M - £8M+ complete system

5G Integration and Remote Production Revolution

The integration of 5G wireless networks represents a fundamental transformation in outside broadcasting operations, enabling ultra-low latency connectivity, massive bandwidth capacity, and network slicing capabilities that guarantee quality of service for critical broadcast applications. This technological advancement facilitates remote production workflows that reduce on-site crew requirements while maintaining professional production quality.

5G Network Capabilities for Broadcasting

Ultra-Low Latency Applications:

- Camera Control: Real-time PTZ operation from remote locations

- Audio Monitoring: Live monitoring and mixing without perceptible delay

- Intercom Systems: Clear communication between on-site and remote personnel

- Replay Operations: Frame-accurate control for instant replay systems

Network Slicing Benefits:

- Guaranteed Bandwidth: Dedicated network resources for broadcast traffic

- Quality of Service: Prioritized handling of time-critical communications

- Isolation: Protected from general consumer network congestion

- Scalability: Dynamic resource allocation based on production requirements

Direct Broadcast Satellite Technology: Space-Based Television Distribution

Direct Broadcast Satellite technology represents one of the most sophisticated applications of space-based communications, utilizing high-powered geostationary satellites to deliver digital television programming directly to consumer locations worldwide. This technology bypasses terrestrial infrastructure limitations while providing continental coverage areas, making it particularly valuable for serving rural and remote regions where cable or fiber installations are economically impractical.

Satellite Television Infrastructure: Multiple satellite dishes for reception of direct broadcast satellite signals from geostationary orbit

Satellite Broadcasting History and Industry Milestones

The development of satellite broadcasting spans five decades of continuous technological advancement, beginning with experimental communications satellites in the 1960s and evolving through commercial deployment, digital transition, high-definition implementation, and current ultra-high definition capabilities. Each generation has expanded coverage, improved signal quality, and reduced consumer equipment requirements.

Satellite TV Distribution: Complete satellite television network showing contribution, distribution, and direct-to-home broadcasting infrastructure

Market Transformation: Streaming Competition and Industry Evolution

The satellite television market faces unprecedented challenges from streaming video services, changing consumer preferences, and evolving technology landscapes. Traditional DBS providers must adapt business models while leveraging unique advantages including live sports content, comprehensive programming packages, and rural market coverage.

Strategic Response: Hybrid service models combine satellite delivery with internet-based services, enabling on-demand content while maintaining satellite advantages for live programming.

Geostationary Satellite Orbital Characteristics

Orbital ParametersAltitude: 35,786 km above Earth's equator

Orbital Period: 23 hours, 56 minutes, 4 seconds (sidereal day)

Orbital Velocity: 3.07 km/second

Coverage Area: Approximately 1/3 of Earth's surface per satellite

Line of Sight: Minimum 5° elevation angle for reliable reception

Satellite Positioning and Coordination

Orbital Spacing: 2-3° minimum separation to prevent interference

Station-keeping: ±0.1° position maintenance using onboard thrusters

Inclination Control: North-south position maintenance

Longitude Drift: East-west position correction

Fuel Requirements: 7-10 years station-keeping capability typical

Coverage Patterns and Footprints

Global Beam: Wide coverage for continental areas

Shaped Beam: Optimized patterns matching country boundaries

Spot Beam: High-gain narrow beams for frequency reuse

Multi-beam: Multiple simultaneous coverage areas

Beam Switching: Time-division coverage of multiple regions

LEO vs. GEO Satellite Comparison

Low Earth Orbit (LEO) Characteristics:

- Altitude: 500-2,000 km above Earth

- Latency: 20-40ms vs. 240ms for GEO

- Coverage: Requires constellation of hundreds/thousands of satellites

- Tracking: Consumer antennas must track moving satellites

- Advantages: Ultra-low latency, higher capacity potential

- Disadvantages: Complex operations, higher costs, unproven longevity

Geostationary (GEO) Characteristics:

- Altitude: 35,786 km above Earth's equator

- Latency: 240-280ms round-trip

- Coverage: Continental areas with 3-4 satellites

- Tracking: Fixed consumer antennas, no tracking required

- Advantages: Proven technology, simple ground systems, reliable coverage

- Disadvantages: Higher latency, limited capacity growth

Comprehensive Technology Comparison and Strategic Analysis

Each broadcasting technology serves distinct market segments with specific advantages, limitations, and strategic positioning within the broader media ecosystem. Understanding these characteristics enables informed decision-making for infrastructure investments, service deployments, and technology adoption strategies across different applications and market conditions.

| Technology | Coverage Characteristics | Initial Investment | Operational Costs | Latency Performance | Primary Applications |

|---|---|---|---|---|---|

| Terrestrial Television | 40-60 mile radius per transmitter | $50-300 consumer, $500K-2M+ professional | $0 consumer, $200K-500K annual | Minimal (real-time) | General entertainment, emergency communications |

| CCTV Systems | Local premises, campus-wide | $800-50,000+ depending on scale | $0-500+ monthly for cloud services | Real-time with local processing | Security surveillance, smart city infrastructure |

| Outside Broadcasting | Event-specific mobile deployment | $5,000-2M+ per event production | Project-based with crew and equipment | 50-280ms depending on transmission | Live sports, news coverage, entertainment |

| DBS Satellite | Continental coverage capability | $200-600 consumer plus installation | $50-150+ monthly subscription | 240ms geostationary, 20-40ms LEO | Rural markets, premium content delivery |

Strategic Investment Analysis by Technology Sector

High Growth Investment Opportunities:

- AI-Enhanced CCTV Systems: 16.84% CAGR with expanding applications beyond traditional security

- 5G-Enabled Outside Broadcasting: Remote production reducing operational costs and enabling new service models

- ATSC 3.0 Infrastructure: Next-generation terrestrial broadcasting with datacasting and interactive capabilities

- Hybrid Broadcast-Broadband Services: Convergence opportunities across multiple technology platforms

Stable Infrastructure Investments:

- Terrestrial Broadcasting Equipment: Proven technology with evolutionary improvements and regulatory requirements

- Professional OB Equipment: Consistent demand for live event production with technology refresh cycles

- Enterprise CCTV Systems: Steady replacement and expansion markets across multiple verticals

Declining or Challenged Markets:

- Traditional Satellite TV: Subscriber losses and competitive pressure requiring strategic repositioning

- Legacy Broadcast Equipment: Analog and early digital systems facing obsolescence

- Standalone Security Systems: Integration pressures and smart building requirements

Future Trends and Technology Convergence

The broadcasting technology landscape continues evolving through emerging technologies, changing consumer preferences, and converging platforms that blur traditional boundaries between different broadcasting methods. Understanding these trends enables strategic planning while identifying opportunities for innovation and market development across the entire broadcasting ecosystem.

Emerging Technology Impact Assessment

Virtual and Augmented Reality Integration:

- Immersive Broadcasting: 360-degree video content and volumetric capture for VR experiences

- Augmented Graphics: Real-time overlay information and interactive elements in live broadcasts

- Virtual Studios: Computer-generated environments reducing physical production requirements

- Training Applications: VR-based training for broadcast personnel and security operators

Blockchain and Distributed Technologies:

- Content Rights Management: Automated licensing and royalty distribution systems

- Decentralized Distribution: Peer-to-peer content delivery networks

- Smart Contracts: Automated execution of distribution agreements and payments

- Authentication: Secure device and user identity verification

Quantum Technologies:

- Quantum Encryption: Unbreakable security for premium content distribution

- Quantum Computing: Advanced signal processing and optimization algorithms

- Quantum Sensing: Enhanced detection capabilities for security applications

- Quantum Communications: Secure government and military broadcasting applications

Industry Resources and Professional Networks

Standards Organizations

Leading international organizations responsible for developing technical standards and protocols.

Regulatory Bodies

National and regional authorities responsible for broadcasting regulation and spectrum management.

Professional Organizations

Industry associations providing advocacy, education, and networking opportunities.

Technical Organizations

Specialized organizations focusing on technical development and system integration.